The market state analysis is different from the Elliotware analysis. In the Elliotware we try to determine a constant market structure otpimize on that structure and hope that the solution we have will work out of sample. I have found such a structure on the 1h time frame on the EURUSD. Before that structure we made out of sample analysis on the uptrend with trading solutions. In those examples I used commercial systems (Trading Solutions and Neuroshell Day Trader) to make the analysis because they offered very good statistical evaluations of the trading systems so I could share the results.

The market state analysis is different from the Elliotware analysis. In the Elliotware we try to determine a constant market structure otpimize on that structure and hope that the solution we have will work out of sample. I have found such a structure on the 1h time frame on the EURUSD. Before that structure we made out of sample analysis on the uptrend with trading solutions. In those examples I used commercial systems (Trading Solutions and Neuroshell Day Trader) to make the analysis because they offered very good statistical evaluations of the trading systems so I could share the results.On those examples as they were not rule based we used neural nets it was not possible to use robustness analysis. You know you really do not know what really does the Neural net, what really matters is what data you are going to feed to the net and how you are going to preprocess the data. The strenght of the commercial software is that it has some foolproof safeguards that avoid to the people who do not understand in neural nets to make big mistakes with the neural net parameters (As the Neural nets that are used are different Neuroshell uses some kind of cascade algorythms that adds more neurones as needed, and has a default limitation on the number of neurones limiting the possibilities of overoptimization, Trading solutions is worth because it helps you to follow the good practices for the ration betweensamples to weights ratio for better generalization).

The Market States Analysis

However this time I would make something different as I am using a rule based system of Brain Trend expert (you candownload it here if you haven't downloaded yet).

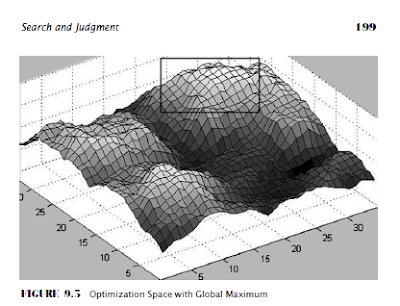

As it is a rule based system we are particularly interested in the optimization space and to find a global optimum.

The Alternation of Market States

There is something very interesting we can observe on the markets and that is the alternation between the market states. This is not magic of course we can have some theories why this occurs but I do not think I know exactly why it happens. The most probable explanation is as there are phases of accumulation of market orders those orders have to be activated. The transitions between accumulation and activation from a common technical analysis perspective is a break - out. You have a trading range and you have a break - out (the mother of all technical analysis strategies).

So basucally we do not have a two step process

accumulation - distribution

we hace probably a 3 step proces:

accumulation - activation - distribution

And as you can guess there is a very complex dynamics between the market states and the processes of accumulation - activation - distribution.

Well we know that most of the sharp impulses are due to cascade of running stops. There can be said a lot more. But let keep it simple right.

So take a look at this chart.

We had a trending and volatile market state, we had a technical break - out. What you could expect is an impulse. So what to do. It is possible to deploy a robust trading system for impuls environment. (By the way there was a change in the fractal dimension structure but I will avoid to comment this in this example I can say that we have also a fractal break - out a transition from a state of High Fractal dimension towards a state of lower fractal dimension).

And I deply on 3 different time frames the Brain Trend expert. This is not an out of sample analysis, this is the optimization space but as I optimize only 1 parameter it is not multidimensional (lol, simpler the better),

On this optimization report it is not shown but it is good you have to make the analysis by yourself using the optimizartion tester.

What is interesting is that the drow down is low. So you can set your risk level for example of 5 %. You will know immediately if you are right or not. Of course a visual inspection of the chart is very useful.

The advantage of playing a system in this manner over manually play the break - out is that a robust implulse following and momentum driven system will not let you go against the trend, even if the first break - out is fake, the system will know when and how to reverse.

When I take a look a month later on those results the same expert is again profitable at all possible settings.

ОтговорИзтриванеSo I would say that it works quite well in trending markets.