30.01.2012 г.

Forex course: a quest for a consistent approach

A Forex course lesson? Yeah again why not. In this Forex course tutorial I would like to point out something I really think is essential for any Forex course.

So where we are? OK. I am talking about a consistent approach to trade the markets. That means basically a procedure what to do in any moment. And that is important, whatever your trading style may be.

Consider for a moment you use third party signals. However what would be your approach, you need to answer some questions.

1. Selection of the signal provider based on some criteria objective and subjective: You need a consistent approach.

2. Eventually making a basket of signal providers to mitigate risks: You need a consistent approach otherwise instead of mitigating the risk you end up with increased risks.

3. How much risk you are ready to tolerate? What is the draw down you are ready to accept?

4. If that happens what are you going to do? Stop trading, changing the position size or keep the things unchanged unless your account is blown or your loss recovered at some kind of break - even point.

5. How often are you going to monitor your portfolio of signal providers?

Take a look at those questions, you need to have an answer for them. And in this example you are not even trading at all, you are not even dealing directly with the market but still you need a consistent approach.

Unfortunately I did not find any simple and available Forex trading course that would deal with those questions. If you have any ideas you may comment but ... So still we are looking for the Forex course that would give a methodology to those kind of questions.

Pattern recognition scanner autochartist: evaluation project

Pattern recognition scanner project, I think it is worth to give it a try. That is why I opened a discussion on beathespread.com about this project. The basic description of the project is not only on fxhackers but also on the blog post on the trader's social network beathespread where some more cases and details are given regarding the practical implementation of the software.

However you need to check the official videos first. That is important because you could make upgrades of your interpretation when you see the original tutorials. The official IBFX sub-page of Autochartist is here. The videos are very professional and get you started very quickly.

I would eventually update this post later with more resources about the tool.

So there would be a PRS evaluation project. I think that this tool did not get the attention and the recognition it deserves by the community of traders.

29.01.2012 г.

Forex course: Is it worth?

Forex course, learn to trade! Does is really means anything in the modern sophisticated and highly competitive environment? Really that is a tough question if by any Forex course you would be a profitable trader. Indeed you need a Forex course but is it really helpful, I am not so sure.

Forex course, learn to trade! Does is really means anything in the modern sophisticated and highly competitive environment? Really that is a tough question if by any Forex course you would be a profitable trader. Indeed you need a Forex course but is it really helpful, I am not so sure.Of course all over internet when you look for a Forex course you would find a myriad of providers of different kind of Forex and trading courses: scalping, swing trading, investment strategies etc.

However from the start there are two ways and you have to choose the way from the beginning. The first thing is to use a third party to trade for you, the other way is to learn to trade by yourself. Of course after that you may combine the approaches but it is a starting choice. As everybody knows time is money and maybe you cannot afford the time to learn to trade, to follow the markets on a daily basis and to adapt to the market conditions. It is an absolute truth that everybody underestimates the time necessary in order to have a proper understanding in the markets. In fact it takes years, and on the other hand it never ends, because the markets change constantly and you have to Research and Develop your strategies in order to keep with the markets.

Well the question is if a Forex course may help you if you choose to trade by yourself? The answer is probably yes, it may help you to learn quite fast the basics. On the other hand the basics of the technical analysis are so simple that anybody can learn them for a week. Really, I am not joking, it is not that hard. The added value of a real Forex course is the possibility to talk with real people. The is what you need to look for. Avoid Forex courses that do not offer to you a communication with real people. You need a communication with real discretionary traders.

However you may ask, this is only about discretionary trading, but what about system trading. Is it different. Sure it is, the system trading is completely different story. However as far as I know there are only courses for discretionary trading, price action and technical analysis. In fact the secrets in system trading are quite well kept, I mean for really profitable systems.

So finally there are some interesting Forex courses available, but it is about discretionary trading, scalping, technical analysis, and stuff like that. You may start with some real feed from experienced traders that give a kind of a Forex courses paid actually by the brokers. In another post I would share some resources and links about free Forex courses.

28.01.2012 г.

Forex course on price action?

Forex course on price action? What about a book for reading price charts "price action" bar by bar.

In this blog post I would like to mention the work of another important author regarding the price action trading. Its name is Al Brooks and the book is Reading Price Charts Bar by Bar by Al Brooks (Reading Price Charts Bar By Bar – The Technical Analysis Of Price Action For The Serious Trader (May 2009).

Al Brooks trades mainly the E-mini S&P 500 using 5 m. charts and the whole book is not written about Forex. However can you use it for Forex trading as a Forex course? I think yes, and that is because the price action as the pattern trading does not diverge. However for Forex trading it is necessary to take into account other factors as correlations and the evolution of volatility during the day. You can check another forex course for pattern trading this is another book for pattern trading, Beat the odds in Forex trading by Igor Toshchakov (l.a. Igrok). If the Igrok's method does not pay attention into the price action dynamics the method of Al Brooks is completely different. A lot of attention is paid what is going on bar by bar within the pattern. So much details are given that I get confused very often at least 3 times per page.

I find the book by Igrok much easier to put into practice and test compared to the Brook's price action analysis. I can say it is impossible to test. You have no idea if it is profitable or not. However as they say in every Forex course is that it is compared to a driving course, your teacher during the driving course has no idea if you are going to have or not a driving accident, the only thing he can do is to teach you as much as he can. So the same goes for any Forex course for price action, or whatever actually.

So the first thing is that that is a method, where a backetesting is close to impossible.

The second thing is that everything depends on the experience. Al Brooks says that he got 10 years of practice without much success. So really it is very hard. Your price action readings may diverge quite a lot with the price action readings of the experienced trader.

Here I would like to add that price actions is not trading without indicators. No the price bars are an indicator per se. The visualization of price action through bar charts is an indicator.

I can say that it is the most confusing book on price action I have ever seen. That does not mean that it is not valuable, but it is confusing. The forex course by Joe Ross is much more comprehensive. However it is stated in the head page that this book is for the serious price action trader. And that is true the forex course within this book is not for a novice trader at all.

23.01.2012 г.

BarclayHedge Indexes

Today while surfing with no particular place to go ;), I visited the BarclayHedge Indexes. It was interesting to see what happened the last year. It looks like almost everybody has lost money. Then I was concentrating to see who actually was making money.

And surprise surprise the market neutral and arbitrage hedge funds were making money, while a lot from the rest were loosing.

The arbitrage hedge funds are more of a roller costs. The fixed income arbitrageurs made actually a nice profit of 4.53% in 2011, 11.65% in 2010, 19.83% in 2009, but it lost 25.2% in 2008 (and that is a capital loss). Something very bad with this strategy happened in Oct 2008. And this is the major decline in the financial crisis. So it looked that those systems were not market independent at all.

The equity market neutral index is interesting the returns were quite small but steady. However the actuall 0.24 % does not look terrible anyway.

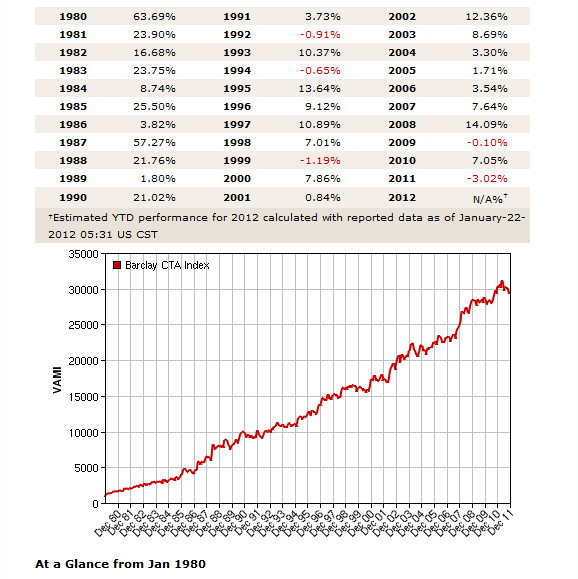

On the other hand the CTA (Commodity Trading Advisors) performance is still good. Look it is interesting how the performance in the 80 ties, it was a stellar performance, some kind of a golden age of technical analysis.

The biggest performance for the CTA was in 2002 and 2008 the biggest historical declines in the stock market. This is of paramount importance with the studies we make here about the pockets of predictability. Those market conditions are characterized by lower entropy and large Hurst exponent. During those times humans can predict the markets pretty well. Look 1987 the biggest performance by the CTA.

And surprise surprise the market neutral and arbitrage hedge funds were making money, while a lot from the rest were loosing.

The arbitrage hedge funds are more of a roller costs. The fixed income arbitrageurs made actually a nice profit of 4.53% in 2011, 11.65% in 2010, 19.83% in 2009, but it lost 25.2% in 2008 (and that is a capital loss). Something very bad with this strategy happened in Oct 2008. And this is the major decline in the financial crisis. So it looked that those systems were not market independent at all.

The equity market neutral index is interesting the returns were quite small but steady. However the actuall 0.24 % does not look terrible anyway.

On the other hand the CTA (Commodity Trading Advisors) performance is still good. Look it is interesting how the performance in the 80 ties, it was a stellar performance, some kind of a golden age of technical analysis.

The biggest performance for the CTA was in 2002 and 2008 the biggest historical declines in the stock market. This is of paramount importance with the studies we make here about the pockets of predictability. Those market conditions are characterized by lower entropy and large Hurst exponent. During those times humans can predict the markets pretty well. Look 1987 the biggest performance by the CTA.

|

| Fixed income arbitrageurs |

|

| Arbitrage Hedge funds |

|

| CTA (Commodity Trading Advisors) performance |

14.01.2012 г.

Autochartist: Pattern Recognition Scanner

Autochartist: Pattern Recognition Scanner, I know this instrument for a while to tell you the truth I have never considered it seriously. I think that it is an interesting and valuable tool for a beginner wishing to learn the technical analysis patterns and to have a second opinion. For example you maybe know theexcellent Encyclopedia of chart patterns of Bulkovski, this is the site of the author. However that was for the Stock market, the most interesting part of the book for me is the probability of success of each pattern. But there were two problems.

1. Those results were for the Stock market and I am in the Forex market.

2. Those results were for patterns identified by Bulkowski I would subjectively see maybe completely different patterns

Those problems do not exist with Autochartist.

1. The results are for Forex

2. The pattern reading is done by a machine so I cannot add my own subjectivity in detecting the pattern

3. What I can do is to filter the market conditions when a profitable pattern is more likely to emerge

4. To filter by my own procedures to take the pattern or not (every trader may have his own procedures but it is possible to miss that step too)

However today I reconsider my opinion. Really. Why?

So check the statistics:

The statistics is for a period 2011-07-04 to 2011-12-28

899 patterns were evaluated and 69 % from them were correct.

Then you can find a table of the results by pattern, by symbol, by time frame and by time of the day.

I can say to you that this is a lot of work. Really there is a serious work done here.

However I would like to add one precision. Those results are not for the patterns in general. Those results are specifically for the patterns identified by the PRS. However and we will never know.

Those results do they come from optimization of the PRS on past history or they are Out of sample results.

I think we would never know. As you can guess to derive patterns you need to have some hidden parameters there and those parameters can be changed and once changed they would give completely different results. As it is proprietary we would never know.

It is also possible that a team is dedicated on this job which is doing constant adjustments of the Pattern recognition scanner Autochartist.

If we ignore that information the results are pretty interesting indeed.

You need an opened account in order to have the full funtionality or you can use the limited functionality with a demo account. However if you install the Metatrader pluggin you can overcome this. In fact in the limited functionalyty they give you a plain picture on the more exotic paris and neveron EUR/USD, however if you install the metatrader indicator you will have it in Metatrader and you will see the chart in your Metatrader and you can use the separate software for scanning arround the market.

Download link

1. Those results were for the Stock market and I am in the Forex market.

2. Those results were for patterns identified by Bulkowski I would subjectively see maybe completely different patterns

Those problems do not exist with Autochartist.

1. The results are for Forex

2. The pattern reading is done by a machine so I cannot add my own subjectivity in detecting the pattern

3. What I can do is to filter the market conditions when a profitable pattern is more likely to emerge

4. To filter by my own procedures to take the pattern or not (every trader may have his own procedures but it is possible to miss that step too)

However today I reconsider my opinion. Really. Why?

So check the statistics:

The statistics is for a period 2011-07-04 to 2011-12-28

899 patterns were evaluated and 69 % from them were correct.

Then you can find a table of the results by pattern, by symbol, by time frame and by time of the day.

I can say to you that this is a lot of work. Really there is a serious work done here.

However I would like to add one precision. Those results are not for the patterns in general. Those results are specifically for the patterns identified by the PRS. However and we will never know.

Those results do they come from optimization of the PRS on past history or they are Out of sample results.

I think we would never know. As you can guess to derive patterns you need to have some hidden parameters there and those parameters can be changed and once changed they would give completely different results. As it is proprietary we would never know.

It is also possible that a team is dedicated on this job which is doing constant adjustments of the Pattern recognition scanner Autochartist.

If we ignore that information the results are pretty interesting indeed.

You need an opened account in order to have the full funtionality or you can use the limited functionality with a demo account. However if you install the Metatrader pluggin you can overcome this. In fact in the limited functionalyty they give you a plain picture on the more exotic paris and neveron EUR/USD, however if you install the metatrader indicator you will have it in Metatrader and you will see the chart in your Metatrader and you can use the separate software for scanning arround the market.

Download link

6.01.2012 г.

About money management and the trading roller coaster

This post is absolutely not for experienced traders, absolutely not.

What about money management! What about trading Forex! what are you going to expect from it?

What is the correct setting of the money management what are your risks?

In the previous post I talked about the psychological implication leading you to a spiral of over implication. That is a threat. In order to mitigate the risk you need to aknowldege it. OK enogh for that.

Again what about money management!

In other posts (I do not remember where) I talked about trading with low leverage and having realistic objectives in mind (20 % annual return of capital is considered a big success). Howerver with an average retail account of 2000 $ that makes 400 $ per year and it is really not worth the efforts.

You need much bigger accounts 10 000 $ looks like a minumum, and again it is doubtfull to entertain a family in the civilized workd with 2000 $ pear year. That makes 166 $ monthly income, and you will be very confortable if you live in the basement alone in perfect harmony with the rats and eating junk food.

And imagine you loose your capital what is going to happen? Nothing nice anyway.

OK but if you trade you are going to trade in the risky way, hoping to make 10 000 per month at least. What is going to happen? Some are going to make it of course but considering you the statistical average guy the law of the statistics are going to apply to you and you are going to loose it.

All the 10 000 are going to go into the bank account of the bucket shop operator who on many occasions will not cover your positions on the market.

No really the chances are against you.

On one hand it is really not worht the effort to apply reasonable money management on a relatively acount on the other hand risking the same account (considering it not as small) is going to be a disaster for the small retail newbie trader.

Really it looks like a trap isn't it?

I talked on that on many occasions with friends. It looks like nobody is interested into something making 10 % per year. People are interested in 200 % per month. The alchemy of making amazing money from money is exactly the same as making gold from other metals.

No really I want to tell you from the start what I think. Consider this only if you like the process, not the results.

Well what to do?

One of the things that most people do is taking a small account and trading really risky? Is it against correct money management. I do not think so provided it is a small capital you risk like crazy.

The rules about money management consern your entire capital. It is all relative. Consider you have 10 000 as trading capital. A conservative money management (it is much more complicated than that) would say not to risk more than a fraction of this capital, let say 5 % (that makes 500 USD).

So what, imagine you have 500 USD how you are going to trade depends entirely on your perspective, it is different if those 500 USD are your entire trading capital or they are 5 % of your trading capital.

Many experienced traders open 500 USD accounts and they trade like deamons from hell risking crazy, but if you consider that 500 USD is just 5 % of your entire capital the perspective is different.

I have seen how a trader turns 50 $ into 2500 $ in 8 hours. Ask musketeer he was a testimony. However this is financial alchemy and happened only once.

So most of the trading hobbyists are doing exactly that using small accounts and hoping that they will make the BIG gain, that is cools and everybody that makes that is the short lived start on all the forums.

So what is money management? What do you expect? I believe you expect to make the big profits, eah I know there is something magic to open one lot and to see how in 5 minuts you make 200 USD. I know and that is a big temptation.

What about money management! What about trading Forex! what are you going to expect from it?

What is the correct setting of the money management what are your risks?

In the previous post I talked about the psychological implication leading you to a spiral of over implication. That is a threat. In order to mitigate the risk you need to aknowldege it. OK enogh for that.

Again what about money management!

In other posts (I do not remember where) I talked about trading with low leverage and having realistic objectives in mind (20 % annual return of capital is considered a big success). Howerver with an average retail account of 2000 $ that makes 400 $ per year and it is really not worth the efforts.

You need much bigger accounts 10 000 $ looks like a minumum, and again it is doubtfull to entertain a family in the civilized workd with 2000 $ pear year. That makes 166 $ monthly income, and you will be very confortable if you live in the basement alone in perfect harmony with the rats and eating junk food.

And imagine you loose your capital what is going to happen? Nothing nice anyway.

OK but if you trade you are going to trade in the risky way, hoping to make 10 000 per month at least. What is going to happen? Some are going to make it of course but considering you the statistical average guy the law of the statistics are going to apply to you and you are going to loose it.

All the 10 000 are going to go into the bank account of the bucket shop operator who on many occasions will not cover your positions on the market.

No really the chances are against you.

On one hand it is really not worht the effort to apply reasonable money management on a relatively acount on the other hand risking the same account (considering it not as small) is going to be a disaster for the small retail newbie trader.

Really it looks like a trap isn't it?

I talked on that on many occasions with friends. It looks like nobody is interested into something making 10 % per year. People are interested in 200 % per month. The alchemy of making amazing money from money is exactly the same as making gold from other metals.

No really I want to tell you from the start what I think. Consider this only if you like the process, not the results.

Well what to do?

One of the things that most people do is taking a small account and trading really risky? Is it against correct money management. I do not think so provided it is a small capital you risk like crazy.

The rules about money management consern your entire capital. It is all relative. Consider you have 10 000 as trading capital. A conservative money management (it is much more complicated than that) would say not to risk more than a fraction of this capital, let say 5 % (that makes 500 USD).

So what, imagine you have 500 USD how you are going to trade depends entirely on your perspective, it is different if those 500 USD are your entire trading capital or they are 5 % of your trading capital.

Many experienced traders open 500 USD accounts and they trade like deamons from hell risking crazy, but if you consider that 500 USD is just 5 % of your entire capital the perspective is different.

I have seen how a trader turns 50 $ into 2500 $ in 8 hours. Ask musketeer he was a testimony. However this is financial alchemy and happened only once.

So most of the trading hobbyists are doing exactly that using small accounts and hoping that they will make the BIG gain, that is cools and everybody that makes that is the short lived start on all the forums.

So what is money management? What do you expect? I believe you expect to make the big profits, eah I know there is something magic to open one lot and to see how in 5 minuts you make 200 USD. I know and that is a big temptation.

4.01.2012 г.

Different types of trading strategies

No that thing does not exist that will beat the market with just one settings, omething like set and forget.

No speculative trading is a process that does not stop.

I know several common but different frameworks that work, but they work as a process.

1. A system with high percentage of winners, that looses with big and sudden drowdowns.

This kind of system may be consistently profitable if you know at what conditions the black swan event will occur and take appropriate measures.

And that is a very difficult balance.

One of such systems is the Swissy system. We observed in real time how it was making money and at what conditions it was expected to loose money.

2. Second type of systems are when you expect a big winner but you are risking small amount of money.

That strategy is having a very low percentage of winners but have a positive mathematical expectation. For example Nasim Taleb recommends this trading phylospophy when for example he bys options out of the money. That is how the extreme fortune of Soros has been made.

3. The third type of systems is where you really want to beat the market, by modeling the market and by adapting your system to the current market behaviour.

I shared this approach woth the elliotware and market state analysis and with several out of sample experiments using different software, neuroshel day trader and trading solutions.

Usually this kind of system need to have a very low drow down not more than 6 %.

4. Detecting a recurring market pattern.

For example series of tests proved that trading break - outs and if you try to do this in GMT "the european afternoon" you are not going to make it. This is the pattern recognition scanner, if you trade chart patterns you absolutely need to dig into it.

And it is interesting that the traditional 9 o clock fails too.

5. I won't talk about stat arb because I have a remote idea about it.

2.01.2012 г.

Is Speculative Trading a rational decision?

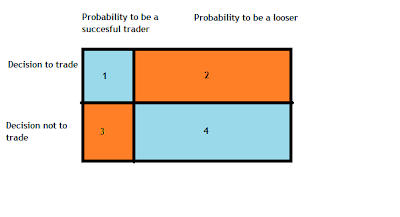

Is Speculative Trading a rational decision? We can use a payoff matrix to put some light into this question. You can also read the first analysis by decision theory of Blaise Pascal.

In our example we use this in the realm of trading. So the question here is what is the payoff of the decision to be a trader or not to be a speculative trader.

However here I make a little change, it is a strange change but I allow myself to make it. The change is that I use not a symetrical probability but asymetrical because we all know that most of the retail traders fail, and that is known to everybody. Everybody on the net talks about that, ot goes from 90 % to 99 % percent even at Zero hedge they claim 100 % depending on the time horizon.

So we have a an asymetric and probabilistic payoff matrix here.

The columns represent the probability to succeed as a trader

The lines represent the decision to trade or not to trade

And we can analyse the payoff. I use colours even if it is better to use numbers.

So let see Cell No 1: Blue colour

In this cell we have decided to be a speculative trader and we do succeed. This is the dream of everybody. To make the decision to be a trader and to succeed.

However this is a very small cell because the probability is against you.

Cell No 2: Orange colour

In this cell we have decided to be a speculative trader and you do succeed. Eveybody thinks that this won't happen to him but there are most of the traders.

This is a big cell, there is a bigger probability to fall into this cell no matter how much you try, no matter how much you work, no matter how much sphisticated instruments and back tests you do.

Cell No 3: Orange colour

In this cell we have decided NOT to be a speculative trader and we would succeed if we have decided to trade. We loose a possibility of gain. And that is bad for us.

Cell No 4: Blue colour

In this cell we have decided NOT to be a speculative trader and we would loose if we have decided to be a trader. So that was a good decision that is why we colour in blue.

So after we plotted the decisions let analyse them.

Intuitively you would see that in the lines with the decision not to trade there is more blue colour and the line with the decision to become a trader there is red colour.

So the decision not to become a professional trader has a bigger payoff than the deicion to be a trader.

Interesting and the rational choice is not to become a trader because this decision has a bigger payoff. What do you think about it?

I can ask some speculative questions? Imagine that the speculative traders should be irrational because of their choice to become a trader would you expect them to make rational choices once they are traders. And as the economic theory is based on the rational choice would you expect our friends the traders to make rational speculative decisions.

Абонамент за:

Публикации (Atom)